Monthly Mortgage Payment

Your total monthly mortgage payment is based on a few different factors: Loan Amount, Interest Rate, and Loan Term. The amount of interest paid each month is based on your remaining loan amount, your interest rate, and the number of days you held the loan that month.

Use the mortgage calculator below to explore how your Loan Amount, Interest Rate, and Term in Years effects your monthly payment.

Amortization Schedules

An amortization schedule is the exact principal and interest breakdown for each of the scheduled monthly payments made during the duration of any loan term. For instance, a 30 year mortgage would have 360 scheduled monthly payments, a 20 year mortgage would have 240 scheduled monthly payments, etc. You will see that during the earlier payments, considerably more of the scheduled monthly payment goes to interest and the smaller remaining balance is applied to principal, thereby reducing the loan balance. Conversely, you will see that the later payments will show the opposite, that is, considerably more of the scheduled monthly payment goes to principal with less and less going to interest.

This is due to your monthly mortgage payment staying constant, where the amount of interest you pay each month being reduced due to paying down your principal and having a new lower loan balance.

The interest paid each month is based on your remaining loan amount x your interest rate / 365 days x days in that month.

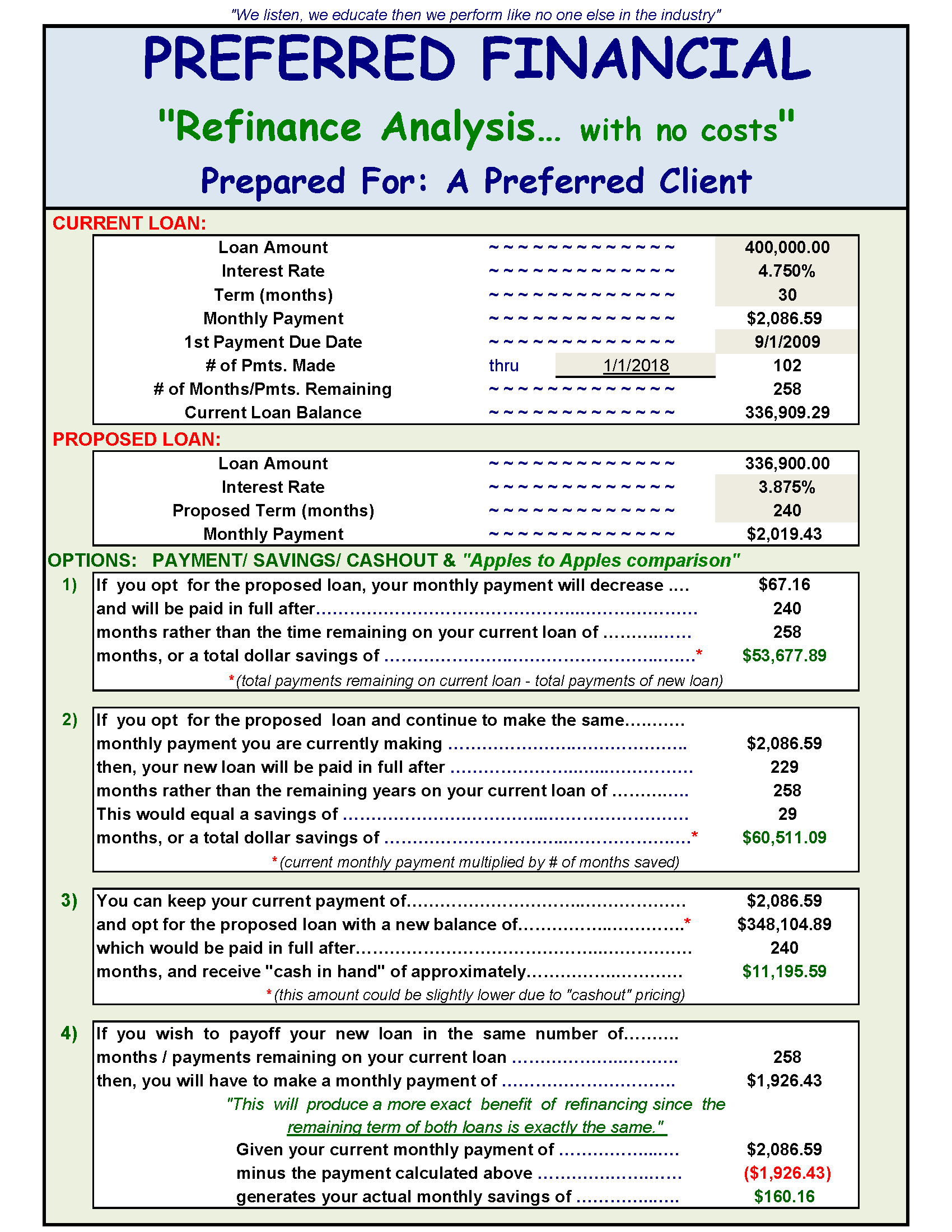

Refinance Analysis

We developed our Refinance Analysis calculator over ten years ago in response to some of our clients’ concerns about refinancing for a lower rate, but having to start again with a new 30 year mortgage.

One of the first discussions we have with a borrower is whether or not we can improve on their existing loan through a “no fee, no point loan” or what we refer to as a “no cost loan”.

Our Refinance Analysis calculator looks at the difference in monthly payment and difference in amount of interest paid over the life of the loan. These figures give us a clearer perspective on if a refinance will truly financially benefit our clients. Contact one of our Loan Officers for a custom Refinance Analysis to determine your potential mortgage savings.