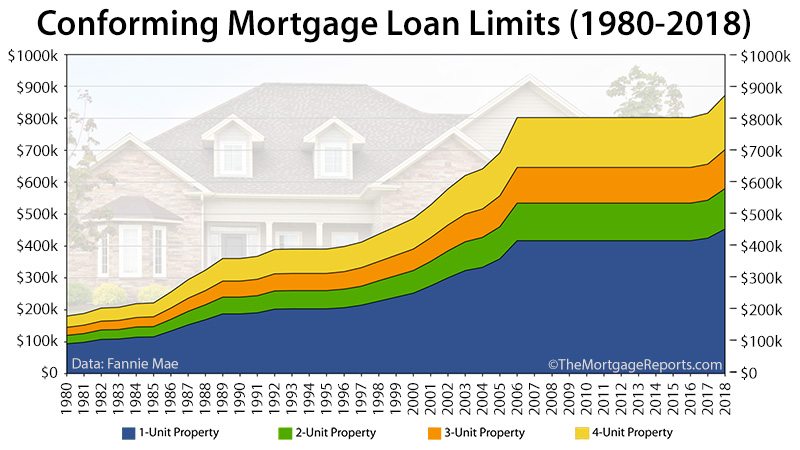

History Of Conforming Loan Limits

Each year, Fannie Mae and Freddie Mac establish the maximum loan amount that qualifies for a “conforming” loan as well as re-evaluating existing credit and income requirements, down payment and suitable properties. A history of annual conforming loan limits for one, two, three and four unit properties since 1980 is provided below.

FHA Up Front Mortgage Insurance Premium

The FHA Up Front Mortgage Insurance Premium is currently 1.75% of the loan amount, either financed onto the loan amount or paid at closing by the borrower or with lender credit. As you can see from the chart below, the Upfront MIP charge has changed over time, but has remained unchanged at 1.75% since January 2015. In addition to the one time upfront MIP payment, there is a monthly mortgage insurance premium. This monthly MIP is made along with your principal and interest payment to the lender. As you can see below, this monthly MIP has changed over time and is currently at 0.85%, which is an annual MIP percentage.

| Change Date | Upfront MIP | Monthly MIP |

| Before July 2008 | 1.50% | 0.55% |

| July 2008 | 1.25%-2.25% | 0.55% |

| October 2008 | 1.75% | 0.55% |

| April 2010 | 2.25% | 0.55% |

| October 2010 | 1.00% | 0.90% |

| April 2011 | 1.00% | 1.15% |

| April 2012 | 1.75% | 1.25% |

| April 2013 | 1.75% | 1.35% |

| January 2015 | 1.75% | 0.85% |

California Home Prices

There are many reports and tools out there to explore the history of California’s Home prices. Zillow is one tool of many out there, where you can get a general idea of value trends, what properties are for sale, which ones have sold near you, and what your home may be worth. For a detailed analysis of a market area or trends, contact one of our Agents who can view MLS listings or comps in a particular area which provides details that are not available to the public.