Mortgage Broker, Mortgage Banker, Banks

Mortgage Brokers:

Independent agencies that contract with numerous, small, large and midsized lenders. Mortgage Brokers do not fund loans in their own name, they are funded by the bank or lender selected. Mortgage Brokers are able to give consumers access to a large range of lenders with one point of contact and one loan application. By using a Mortgage Broker the consumer now puts the shopping for the best bank and rate in the hands of the an expert. Other benefits of using a Broker: Mortgage Brokers now are governed by law to not only show all commission but also cannot change the amount commission midstream as was allowable in the past. That means you know how much the Broker stands to make off your transaction and that the amount cannotbe changed. Before these regulatory changes Mortgage Brokering represented nearly 50% of all loan transactions in the US since the change that has dropped to about 15%.

Mortgage Bankers:

Usually small entities that originate loans and fund in their own name as the lender. Their relationship with banks is not too different than that of the Mortgage Broker. The main difference is that they will use a credit line to fund the loan and then days later they will sell the loan to the bank/lender. The main benefit to the Mortgage Banker is that they do not have to show the consumer how much they will make on the loan transaction; this is because they will not get their profit until later once they sell the closed loan. This allows them to generally make more profits on their loan transactions because the consumer does not have the opportunity to question the amount of compensation. No surprise that prior to the new regulations Mortgage Bankers only made up about 10% of the retail loan production and now they make up roughly 35% of the total US loan closings.

Banks:

Your true depository institutions and in addition to holding your money in checking/savings accounts they make loans to consumers. Banks loan officers have only one place to put loans, their own bank. Banks just like Mortgage Bankers do not have to show what the compensation/profits on the loans.

No Matter which entity originates your loan, 95% of all of the loans will be sold to one of the Agencies: Fannie Mae, Freddie Mac, HUD/FHA and the Veterans Administration. This means the base rates are the same, the only difference is how much profit was generated on your loan transaction. More profit means a higher rate to the consumer.

How Are Mortgage Brokers Compensated?

For their part in facilitating the lending transaction, the mortgage broker receives compensation. Total compensation to the mortgage broker comes in the form of origination fee (generally reflected as a percentage of the loan amount). The method of compensation can vary from transaction to transaction and in any specific transaction a broker’s compensation may be paid in one of two methods: Lender Paid or Borrower Paid.

Lender Paid Compensation:

If the mortgage transaction is set up as Lender Paid, the mortgage broker is paid an origination fee from the lender. On Lender Paid transactions, Mortgage Brokers have predetermined compensation agreements that spell out how much compensation they will be paid on every transaction with that given lender. This predetermined compensation cannot change from borrower to borrower, and can only change every 90 days. This was created to ensure that mortgage brokers give equal consideration to all borrowers. On a Lender Paid transaction borrowers do not pay the origination; the lender pays it on behalf of the borrower with a “lender rebate”. Depending on the amount of the lender rebate, it can also be used cover all other loan fees, making the transaction a true No Cost mortgage.

Borrower Paid Compensation:

If the transaction is borrower paid, then the borrower will directly pay the broker an origination fee. This origination fee must be disclosed to the consumer at the time of the loan application and cannot be increased from the original amount. Borrowers cannot use lender rebate towards paying the broker compensation. Therefore on a Borrower Paid transaction a No Cost mortgage is not an option.

At Preferred Financial we primarily transact only on Lender Paid because of the option to go with a No Cost loan.

Background:

Prior to the Mortgage Melt Down in 2008, mortgage broker compensation was not previously governed by law. Since then everything regarding broker compensation has changed, and continues to do so with the government reform under RESPA. Prior to 2008, the lender rebate was paid directly to the mortgage broker and could be as much as 5.0% of the loan amount. In most cases the mortgage broker never disclosed to the consumer that they were receiving commissions from the lender, nor were they mandated to. What most borrowers did not know was that the higher the interest rate, the more compensation the broker would make. Thus the reason for the change! Unscrupulous brokers would steer their clients to the lenders with the highest rebates even though it was not in their best interest.

Here at Preferred Financial we have always disclosed lender rebate to our consumers and have also always shared the rebate with borrowers in order to cover all of their fees for true No Cost loans.

After 2011, the government mandated that the lender rebate is the property of the borrower. The lender rebate to the borrower can still cover the closing costs including prepaid finance changes, taxes and insurance, but cannot be realized as cash. All brokers must now disclose up front what their compensation will be and it cannot be increased.

This forced the greedier Mortgage Brokers to show what they were making on every deal. Interestingly enough however, Mortgage Bankers still do not need to disclose their compensation to their borrowers because they are paid after the loan is closed and sold to the investor/bank. No surprise that in the last 7 years the number of Mortgage Bankers has exploded, while the number of true Mortgage Brokers has shrunk dramatically.

What Is The Rate Today?

Lenders do not give us a single rate but rather a variety of rates. Often as many as ten or more different rates; some that seem very low and others that seem very high. Why is this?

Rate Sheet Simplified:

Essentially, everyday a lender has a dollar to invest in a mortgage. What they look for at any point in time is a certain percentage return on their dollar invested in a mortgage. This return will change on a daily basis depending on what is happening in the current interest rate environment.

Rate Sheet Explained:

Rate: In the first column on the left, “RATE” simply indicates the range of rates that the lender is offering as of Nov. 14th, 2014. As you can see, the rates range from a low of 3.125% to a high of 4.500%… a total of 14 different rates.

15/30/45 Day: The remaining three columns, 15 DAY, 30 DAY & 45 DAY, represent the rate lock period. This is the period of time that the lender will guarantee the rate. The period begins once a broker notifies the lender of their desire to lock a rate. In order to be protected from rate fluctuations, the loan must fund within the designated lock period.

Rebates: The numbers in the columns below the lock periods represent pricing and the best way to explain this concept is by example.

- Example 1: Assuming a loan amount of $100,000. If a broker wanted to lock a rate of 3.125% for 15 days, the broker would have to pay the lender $5,020 (5.020% x $100,000). If the broker wanted the same rate of 3.125% but instead of a 15 day lock, they wanted a 45 day lock, the broker would have to pay the lender $5,463(5.463% x $100,000).

- Example 2: If a broker wanted to lock a rate of 3.750% for 15 days, the broker would not have to pay the lender at all. In fact, the negative numbers represent the amount that the lender will pay the broker; in this case the lender would pay the broker $753 (-0.753% x $100,000). By locking for 45 days rather 15 days, the amount the lender would pay the broker would decrease to only $283 (-0.283% x $100,000). By now you can probably figure out that a 15 day lock for an interest rate of 4.250% would generate a payment of $3,896 from lender to borrower and a 45 day lock would reduce the lender payment to $3,416.

Explanation:

The lender obviously will like a higher interest rate more than a lower interest rate; hence, they will reward us for delivering a high interest rate loan to our clients. The reward is a higher rebate that the lender pays to us. The lower the interest rate, the less the lender likes this rate and as such the less rebate the lender will pay us. As you continue to reduce the interest rate, you finally get to a point where the lender no longer will pay us a rebate, but rather, they begin to charge us…in other words, we have to pay them for the lower rate.

Each lender has a financial model that is designed to take into consideration a variety of factors and variables. Some of those factors and variables are term of loan, expected life of the loan (there are now some more sophisticated models that take into consideration regional data on expected life of loan…Midwestern and Eastern borrowers tend to hold mortgages longer than “we Californians” do), some expectation on the future of the economy and of course the rate and fees paid or charged. The purpose of the financial model is to attempt to achieve the lenders desired rate of return. When a lender inputs to their model the interest rate (note rate) plus or minus the money they pay us for higher interest rates or the money we pay them for lower interest rates, each of the interest rates produce the desired yield to the lender. Hence, lenders are totally indifferent as to the interest rate that is selected.

So when someone asks us “What’s the rate today?” they need to be prepared for an explanation of the above, including current lender wholesale rate sheets.

How are Mortgage Rates Determined?

Contrary to popular belief, mortgage interest rates are not determined by a single person or a group of people sitting in an ivory tower somewhere in Anytown, USA, attempting to take advantage of us. Rather, they are determined by market conditions that change daily. These market conditions would entail both micro and macro events impacting the current and anticipated state of the economy.

Rate Changing Events:

A few examples of microeconomic events would be the September 11th terrorist attack, the Florida hurricanes of ’04 or the sudden spike in the price of oil. On the other hand, a few examples of macroeconomic events would be inflation, employment, or government deficits. These macroeconomic events are the ones most closely watched by the FED in their efforts to maintain a well-balanced economy

While the FED is diligently attempting to fine tune the economy by affecting interest rates on Treasury Bills, Notes and Bonds, these actions are simultaneously impacting mortgage rates. This relationship is best illustrated using the example of an investor like you or me wanting to invest, say, $1,000. While there are many investment choices available to us, let’s assume that we have narrowed our choices to either a U.S. government bond or a mortgage-backed security. (The current yield on mortgage back securities determine current mortgage interest rates.)

Yields:

Let’s further assume that the current yield or rate of return on the bond is 5.000% and the current yield or rate of return on the mortgage backed security is 7.500%. In which should we invest? If we invested our $1,000 in the bond, we would receive $50 per year; if we invested in the mortgage-backed security, we would receive $75 per year. Duh…..give me the $75 per year! Oh, but not so fast – While there is little or no risk associated with the bond, there is a certain degree of risk associated with the mortgage investment. So we need to evaluate the risk in the mortgage investment and determine if the extra $25 per year is worth the added risk. After evaluating the risk, we decide that the extra return is worth the extra risk so we purchase the mortgage-backed security, and interest rates for mortgages remain constant at 7.500%.

During the following month or so, the FED is busy tightening interest rates which cause the yield on the bond to increase from 5.000% to 6.000%. Will this affect mortgage interest rates? Yes it will, because of investors like us. We are still holding our investment in a mortgage backed security yielding 7.500%, remembering that our decision was based on the extra $25 we were receiving for the additional risk we were taking. However, since the bond is now yielding 6.000% or $60 per year the dollar premium for the additional risk is reduced from $25 to $15. Realizing this, we decide to sell our mortgage-backed security and purchase the bond with the higher yield…presumably, other investors holding the same mortgage backed security would do likewise for the same reason. As more and more investors like you and I continued to sell our mortgage-backed securities, the price of these securities would eventually fall to the point where they would once again pay a dollar premium of $25 for the additional risk. Thus if we were receiving $60 on our new bond investment, we would not consider switching to another mortgage-backed security investment until such time that the annual return is $85. At that point in time, we would sell our bond in favor of purchasing the mortgage-backed security with a yield of 8.500%, hence, establishing the new mortgage interest rate of 8.500%.

What is the Annual Percentage Rate (APR)?

While not too many lenders, mortgage brokers, borrowers, government regulators and consumer advocate groups can agree on an exact definition of Annual Percentage Rate (APR), they can and do readily agree that the concept is a good one.We will not be able to provide you with the exact definition. However, we hope to provide you with some lending industry history, a little bit on government intervention, a simplified example or two, as well as pointing out some minor weakness inherent in APR calculations, all in an effort to better educate you on this subject.

Explained:

APR is the percentage representation of all credit related costs associated with consumer borrowing. The most significant of these credit costs is interest paid on a loan as determined by the borrowing rate or note rate (typically the advertised rate). It is not uncommon to see an advertised rate of 6.00% (borrowing rate or note rate) with an APR of 6.32% or more. It is the “other than” interest related credit costs that are responsible for the rate differential of .32%. So let’s learn what they are and how they impact the rate.

History:

Many years ago when a homeowner sought a mortgage, it was common practice to visit the bank with which he/she normally did business and secure a mortgage there. Bankers welcomed these borrowers and discovered that they were almost always agreeable to accepting whatever rate was being offered. Since these borrowers were so willing to accept what bankers offered, the bankers became a bit overzealous and began charging additional fees for these loans. These additional fees were called points and represented a percentage of the loan amount (one point equals one percent). These fees eventually increased to where it was very common practice for bankers to charge two points, slowly leading to borrowers assuming that all loans cost two points.

Eventually, this practice became more of a concern to the government, not because of the additional charges but because proper disclosure was not being made to the borrower.

The government’s contention was that while the borrower had to repay the loan amount of $100,000, the lender actually loaned the borrower only $98,000.00 (Loan Amount $100,000 minus Loan Fees $2,000). The lender was well aware of it…..they only had to fund the $98,000 amount. The borrower was well aware of it….they only received $98,000. So what was the problem? The government was fine with the $98,000 loan amount but claimed that the 6.00% interest rate in the example above reflected a loan amount of $100,000, not $98,000. Hence, the 6.00% interest rate was incorrect. How can we be sure? Well, mathematically there are only four variables that impact a mortgage. They are:

- Loan Amount

- Interest Rate

- Term

- Monthly Payment

Laws:

In this example, the 6.189% is what the government says is the APR and needs to be properly disclosed to borrowers during the initial stages of the lending process. This lender disclosure was mandated by Congress in 1968 and became law with the passage of the Truth in Lending Act, which was part of the larger Consumer Protection Act.

The law went beyond just loan points in the APR calculations. They mandated that all loan costs must be included in the calculation and, when followed by all lenders, it provides the borrower with a valid basis for comparisons from lender to lender. However, the definition of loan costs often differs between lenders and as such the APR calculations would also differ between lenders, thereby reducing the validity of loan comparisons.

Generally speaking, the loan fees that are a part of the APR calculation are the following:

*(We generally agree with all of the above fees with the exception of Prepaid Interest. Prepaid Interest can impact the APR by as much as .10% depending upon when the loan funds during the month…..earlier in the month the higher APR, later in the month the lower APR

Some fees incurred during the loan process that are occasionally included in the APR calculation are as follows:

- Application Fee

- Attorney Fees

- Flood Certification Fee

- Life Insurance Fee

Some fees incurred during the loan process that are not part of the APR calculation are as follows:

- Appraisal Fee

- Credit Report Fee

- Escrow Fee

- Title Insurance Fee

- Notary Fees

- Recording Fees

- Taxes

- Courier Fees

Why Is My Credit Score More Important Than Ever?

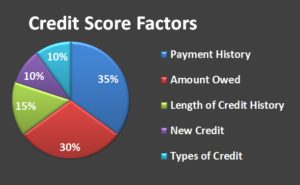

As I am sure you are aware, for decades now we have had a scoring system whereby the computers of the three major credit bureaus (Experian, Equifax and Transunion) assign your credit profile a score or a grade. You probably have a good idea of what your score is, but most of you and even most mortgage professionals do not really know what makes up the score. The pie chart below shows what factors make up the recipe for your credit scores. Most everyone assumes that payment history is the only truly important factor. However, we have seen first-hand over the last several years that the ratio of balance vs. the amount of credit available credit cards is almost as important as payment history. As mortgage professionals we have seen many examples of clients with long credit histories free of credit blemishes, but whose credit scores have dropped from the high 700’s to the high 600’s/low 700’s. Why? Because they happen to have made a large purchase in a given month, pushing the balance owed closer to the max high credit limit.

Before the mortgage meltdown of 2008, a 680 credit score was considered strong and had little to no impact on the Fannie Mae or Freddie Mac loans. Now the two agencies have adopted “Risk Based Pricing” which factors in both your credit scores and your mortgage loan-to-value ratio (LTV). As the credit score goes down, the adjustment to interest rate pricing goes up. If the LTV of your mortgage also goes up, then there are further increases to the interest based pricing. (A copy of the Risk Based Pricing Chart is posted on our website).

In April of this year Fannie/Freddie will further tighten up the Risk Based Pricing and the adjustments, making them more punitive than ever before.

Example:

Borrower A has a middle credit score of 789, a first mortgage of $400,000.00 at 75% LTV and an Equity line of $65,000.00 with a total LTV of 88%. Because of the high score, there is only adjustment to pricing is .250% of the loan amount ($1,000.00), this due to the total LTV being over 80% but no hit for credit score.

Borrower B has a middle credit score of 689, a first mortgage of $400,000.00 at 75% LTV and an Equity line of $65,000.00 with a total LTV of 88%. Because of the low score there are much higher adjustments to pricing in this case 2.00% of the loan amount ($8,000.00). There are two adjustments one for the low credit score and the other due to the total LTV ratio being over 80% with a low score.

Bottom line: Know what makes up your credit scores and manage your credit usage accordingly or you will end up throwing money away. We advise our clients to keep credit card balances below 50% of the line amount whenever possible. If you must charge a high item, do what you can to hold off purchasing until after your refinance/purchase transaction is complete. Have a plan devised to pay the debt down or off in the shortest amount of time as possible.

New for 2011: Fannie Mae’s Loan Quality Initiative requires that the lender re-pull your credit within 10 days of funding a loan. Any changes in credit balances or credit scores will have to go back to an underwriter for review. This can delay the process and possibly result in credit denial if the new debt causes you to no longer meet the income to debt requirements, or could result in a change in the cost of your loan through changes in the Risk Based Pricing.

Impact of Balance vs. Credit limits.

| 0-30% HCL – Little no impact on scores

31-50%HCL- minimal impact 51-75%HCL- moderate impact 75-100%+HCL- Substantial impact |

To learn more about what you can do to maintain strong credit scores, we recommend that you visit http://www.scoreinfo.org

What Is The Federal Reserve’s Role?

The Federal Reserve System was created in 1913 when Congress passed the Federal Reserve Act. This Act established the Federal Reserve Board together with 12 regional Federal Reserve Banks which essentially act as our central bank to handle government transactions, coordinate and control commercial banks, and most importantly help control the nations’ money supply and credit conditions.

The FOMC:

The most powerful committee within the FED is the Federal Open Market Committee (FOMC). It consists of twelve members five of who are representatives from the 12 districts and a seven-man Board of Governors. This committee meets every six weeks and it is their duty to establish a current position on the interest rate climate. If they believe that the economy is over heated, they will tend to tighten interest rates and if the economy is contracting, they will tend to ease interest rates. While there are several methods used to ease and tighten credit, the most prevalent is changing the discount rate. This is the rate at which commercial banks can borrower from the FED. The theory is if the commercial banks can borrower at lower rates, then they should make lower rates available to their customers (the consumers). Conversely, if the cost of borrowing increases for the commercial banks, the banks will pass that onto their customers.

Example:

An example of how this works is as follows. If the economy is sluggish and the FED wants to increase economic activity they will attempt to motivate the consumer to increase spending (since 2/3 of the economy is the result of consumer spending activity). If you have a consumer sitting on the sideline not wanting to purchase that car, refrigerator, computer etc, by making the cost of borrowing cheap enough at some point the consumer will ultimately make that purchase, which in turn helps the economy expand out of that sluggish phase. Conversely, if the economy is over heated (expanding too rapidly resulting in increased inflationary pressure…..too many dollars chasing too few goods), the FED will act by increasing the discount rate which will make the cost of purchasing that item much higher so that the consumer decides not to purchase. This ultimately will result in an economic slowdown.

What Is A Blended Interest Rate And How Is It Calculated?

Perhaps the best way to explain a blended interest rate is to begin by explaining what it is not. It is not an average interest rate. That is, it is not determined by adding each interest rate and dividing by the number of interest rates (or, stated slightly differently, summing each interest rate and dividing by the number of loans).

Should I Buy Down My Interest Rate?

First of all, it makes no difference to us whether you buy-down an interest rate or elect a no cost loan. Our job is to assist you in making the best possible decision with respect to selecting a type of loan as well as the interest rate. An excellent starting point is to attempt to estimate how long you anticipate living in the property? If the answer to that question is less than eight years then under no circumstance should you buy down an interest rate since it takes approximately eight years to recoup the cost of the buy-down.

What Is Prepaid Interest?

Over the years, we have had a lot of fun with discussions about prepaid interest…this is the area where many borrowers believe if they refinance their home loan, they will be rewarded by the lender by being allowed to skip a payment. We might be that nice, but I can assure you lenders are not. Prepaid interest is also the reason many purchasers are told that it is better or less costly to close their transaction at or near the end of the month rather than earlier in the month. Let’s see if we add to the haziness of this concept or make it crystal clear with the details that follow.

Explained:

First of all, we need to understand that lenders are in the business to earn a profit, hence, a “give away” is not a term they embrace. So don’t expect to “skip” a payment in a refinance situation. Lenders expect to be paid interest from the day they make the loan to the borrower until the day that loan is paid in full…no more, no less.

Secondly, many borrowers equate monthly mortgage payments to monthly rental payments. While a monthly rental payment is typically due on the first day of the month and covers the rent through the end of the month, a monthly mortgage payment is somewhat different. When a borrower makes a monthly mortgage payment typically due on the first day of the month, that payment is covering the period for the prior month. That is, by making a mortgage payment due April 1st, you’re actually paying for the loan outstanding during the month of March. This is referred to as paying interest “in arrears”…..due today but covering a prior period vs. due today and covering a future period.

What Is A Prepayment Penalty?

Defined:

Any prepayment penalty will be stated as a clause in the mortgage contract stating that if a mortgage is paid off within a specified period of time, a penalty will be assessed. The prepayment penalty is often determined by a percentage of the remaining mortgage balance, or a certain number of months’ worth of interest.

Prepayment:

All loans allow borrowers to make prepayments of any amount at any time during the term of the loan. Prepayments usually occur in three situations.

- When an amount paid monthly exceeds the regular payment.

- When an existing loan is paid off as part of a refinance.

When an existing loan is paid off as part of a sale.

Most loans allow borrowers to make these prepayments without incurring any

additional costs. Thus, leaving the balance of loans which allow borrowers to make prepayments albeit subjecting themselves to possible prepayment penalties.

Characteristics:

- Prepayment Penalty Periods typically range from one to five years with the most common term being three years. Once this period has expired you will not be assessed a penalty if you prepay the loan.

- Most lenders allow the borrower to prepay up to 20% of the original loan balance within any consecutive twelve month period (not calendar year) without incurring a penalty.

Types:

Prepayment penalty feature are often referred to as “hard” or “soft” penalties. Essentially, a “hard” prepayment penalty will be assessed anytime a prepayment is made which is greater than 20% of the original loan balance including refinances and sales.

A “soft” prepayment penalty allows the borrower to payoff the loan without penalty in the event of the sale of the property. Given a choice, the borrower would be much wiser to choose a “soft’ rather than a “hard” prepayment penalty. However, at Preferred Financial we believe the best choice is probably to select a loan without any type of prepayment penalty.

Questions to Ask:

So then, if you are being offered a loan with a prepayment penalty, you absolutely need to ask if there is a loan you qualify for that does not have a prepayment requirement. Actually, here are a few other questions you should ask:

- What lender is offering this loan?

- Can you provide me with a copy of their rate sheet?

- How much will you be paid if I accept the loan you are proposing?

- Will I be charged any points for the proposed loan?

- Will you be paying any of my closing costs with the rebate, if any, you will be receiving?

- Why did you suggest the loan with the prepayment penalty?

What Is Negative Amortization?

Definition:

Negative Amortization is the increase in a principal loan balance by making monthly payments that fail to cover the interest due. The remaining amount of interest owed is then added to the loan balance. This results in the borrower owing more money on their loan.

Explained:

With new guidelines and regulations, Negative Amortization loans are virtually extinct. Just the sound of the term negative amortization makes many people cringe and it should. It’s not because a loan with a negative amortization feature (Neg Am) is inherently bad, but rather because many borrowers simply do not understand the feature. Because of the negative connotation of this term, we believe the industry is in the process of renaming this type of loan. Nowadays, this type of loan is frequently referred to as a “Payment Option ARM” or a “Graduated Payment Mortgage”. While much more pleasing to our ears, it remains the same loan and that’s fine, as long as the borrower understands how it works.

History:

These loans became popular in the late 70’s and early 80’s when interest rates in general and mortgage rates specifically were at or near all-time highs. They provided borrowers the ability to qualify for mortgages using “start rates” or “teaser rates” which were slightly below traditional market rates. These below market rates reduced the borrower’s monthly payment obligation which ultimately allowed borrowers to qualify for larger loan amounts.

Can Prepayment Penalties be Avoided?

Yes. In most cases, a borrower can avoid having a prepayment penalty on their loan. Unfortunately it may require some questioning and investigation. Remember, in theory, a loan with a prepayment penalty feature should provide the borrower with a lower interest rate. However, in reality, a loan with a prepayment penalty generally puts more money in the pockets of a lender or mortgage broker.

We believe that the more you know about prepayment penalties, the less likely it is that you will end up with a prepayment penalty. Think about it. If you’re talking to a lender or broker about a loan and you question the prepayment penalty feature, they will have to assume that you have some knowledge about this feature and therefore will be less likely to steer you there.

Questions to Ask:

Here are a few questions for the lender or mortgage broker:

- “Does the loan you are discussing have a prepayment penalty?”

- “Will it benefit to me to accept a prepayment penalty?”

- “Is it a soft or hard prepayment penalty?”

- “How is the prepayment penalty calculated?”

- “Will it be indicated in the Truth In Lending Disclosure you will provide me?”

- “Can I review any Prepayment Penalty Addendums, Riders or Disclosures?”

- “Can I buy out the prepayment penalty?”

- “Are there other loans for me without a prepayment penalty?”